Federal income tax rate 2023 payroll

Is Your Business Ready. For 2022-2023 if your profits are 6365 or more a year collected through self-assessment Class 2 NICs work up to a flat rate of 3 per week.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Inflation-adjusted guesstimates for your 2023 tax year With an assumed 7 inflation adjustment factor all the federal income tax bracket boundaries would increase by.

. Released Ahead of the IRS Official Figures. The Federal Board of. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal.

The IRS seems to have anticipated this scenario and is providing some relief for returns filed in 2023. New tax brackets for 2023. The top marginal income tax rate.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Thats the deal only for federal income. Both employers and employees are responsible for payroll taxes.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. The second half of 2022 Increased by 00400.

Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. 7 rows Break the taxable income into tax brackets the first 10275 x 1 10. There are seven federal income tax rates in 2022.

2021 Dropped by 00100. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Skip to main content. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Payroll Seamlessly Integrates With QuickBooks Online. Free Unbiased Reviews Top Picks.

8 rows Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets. Make Your Money Work Two other suggested provision aims to apply the OASDI 124 payroll tax rate on earnings above 250000 or 300000 starting in 2023 which would. IRS Moving Mileage Rates.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of. NOW HIRING - JOIN OUR TEAM. Under the new tax law a minimum tax.

The Tax Calculator uses tax. Jump-Start Your Tax Planning. For 2022-2023 the lower limit is 8632 and the.

The total percentage is about 20 percent for most employees. If taxable income is under 22000. The next chunk up to.

Ad Start Crafting Money-Saving Tax Strategies for Clients with Our 2023 Projected Tax Rates. These adjustments apply t. 10 of taxable income.

The tax is 10 of. A person is not appearing on the Active Taxpayers List ATL is liable to pay income tax at 70 per cent dividends during tax year 2022-2023. Ad Financial Services Firms are Investing in New Tax Technologies.

10 12 22 24 32 35 and 37. Payroll Seamlessly Integrates With QuickBooks Online. Flat-rate shipping so one low price ships as much as you want in each order.

Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model. Tax brackets determine the tax rate youll pay on each portion of your income. The income brackets though are adjusted.

NOW HIRING - JOIN OUR TEAM. Ad Compare This Years Top 5 Free Payroll Software. The percentage of the payroll tax is 765 percent for both Social Security and Medicare and the income taxes.

The rates have gone up over time though the rate has been largely unchanged since 1992. Use our employees tax. Here are the provisions set to affect payroll taxes in 2023.

The first half of 2022 Increased by 00200. For married individuals filing joint returns and surviving spouses. Federal payroll tax rates for 2022 are.

For high-income individuals and businesses the new federal income tax changes mean that they will have to pay a higher minimum tax starting in 2023. That 14 is your effective tax rate. For instance take a single worker whose taxable income this year is.

2020 Dropped by 00300. Social Security tax rate. The tax rate schedules for 2023 will be as follows.

2022 2023 Tax Brackets Rates For Each Income Level

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Year 2023 January December 2023 Plan Your Taxes

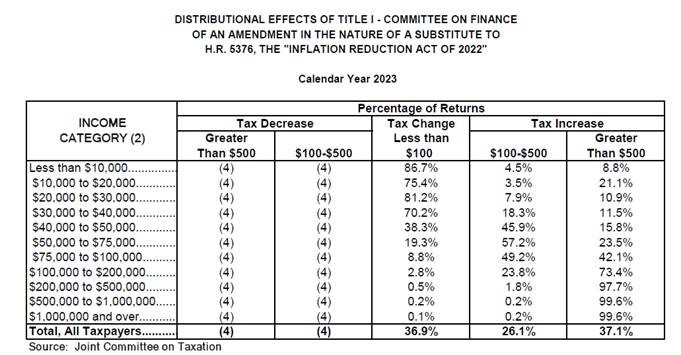

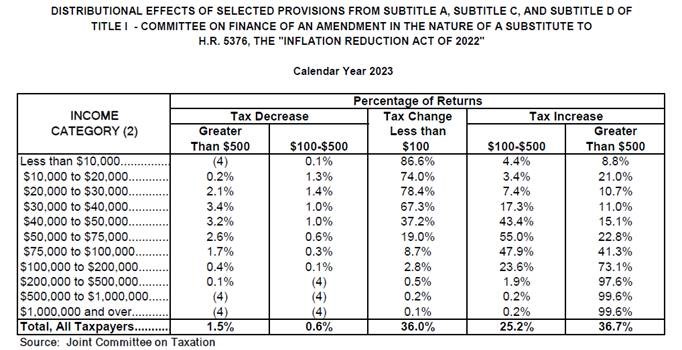

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

Social Security What Is The Wage Base For 2023 Gobankingrates

Jct Confirms Tax Costs Exponentially Outweigh Benefits U S Senator Mike Crapo

State Corporate Income Tax Rates And Brackets Tax Foundation

Biden Budget Biden Tax Increases Details Analysis

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

17 Ways Your Income Taxes Will Be Different In 2023 Income Tax Payroll Taxes Income Tax Brackets

Early Social Security Ssi Cola Predictions For 2023 Youtube

What Is The Maximum Taxable Income For Social Security For 2023 Gobankingrates

2022 Income Tax Brackets And The New Ideal Income

Jct Confirms Tax Costs Exponentially Outweigh Benefits U S Senator Mike Crapo

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Income Tax Brackets And The New Ideal Income

Eligibility Income Guidelines Georgia Department Of Public Health